Updated 3/6/2024: The Federal Solar Tax Credit is still instrumental in helping tax-liable homeowners save money on the transition to solar power. We’ve updated this guide with more information about the tax credit and some changes that have impacted it over the last two years.

If you’re considering going solar, you’ve probably heard about the Federal Solar Investment Tax Credit. The credit allows homeowners to get a tax rebate for 30% of their solar panel system’s cost, which means thousands in savings. So, how does the tax incentive work, and how can you claim it on your tax return?

What is the Federal Solar Investment Tax Credit (ITC)?

The Federal Solar Investment Tax Credit is a credit you claim on your income tax return. The credit covers 30% of the total costs of going solar, including things like labor costs and permitting fees. It’s important to note that you must be tax-liable to claim the ITC. It’s not a check or rebate.

The credit is part of the Inflation Reduction Act, which has made it significantly easier for homeowners to switch to renewable energy sources. The Inflation Reduction Act didn’t stop with solar, either. If you’ve switched to an electric car, there are additional savings you can apply to your tax bill. Be sure to check with your tax preparer to ensure that you’re taking full advantage of them, as it’s possible to miss situation-specific ones.

Who Can Claim the Solar Investment Tax Credit?

Homeowners who have solar installed can claim a credit of up to 30% of the cost of their system. The solar needs to be at your primary or secondary residence, and the system you’re installing must be new and being used for the first time. In other words, if you own a home and pay taxes, you most likely qualify for the Solar Investment Tax Credit.

Some things to keep in mind:

- You must own the system through financing or having paid for the total cost upfront.

- Leased systems do not count toward claiming the tax credit.

- This specific credit cannot be claimed on residential properties that you rent to others UNLESS you live at that location at least half the time.

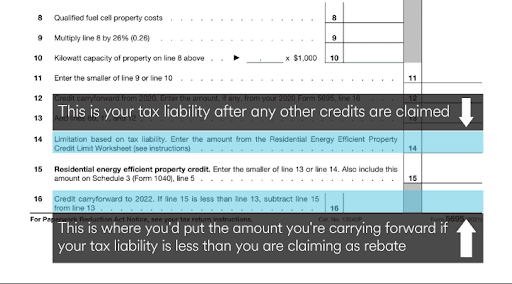

- You can claim the credit even if your tax liability (the amount you owe in taxes) is less than the credit amount you claim. You wouldn’t owe any federal tax the current year, and the next year, you can carry the credit forward to reduce your tax liability by whatever amount is left on the credit.

For instance, if you purchase or finance a solar energy system worth $25,000, you can claim up to $7,500. If your tax liability is $5,000, you wouldn’t owe any federal taxes, and next year, you’d have another $2,500 from the original credit to put towards lowering your tax liability.

How Do Homeowners Claim the Solar ITC?

For most homeowners, you can work with your accountant or tax preparer to make sure they complete tax form 5695 and file it with your income tax return. But if you’re going to do your taxes yourself, we have some helpful tips.

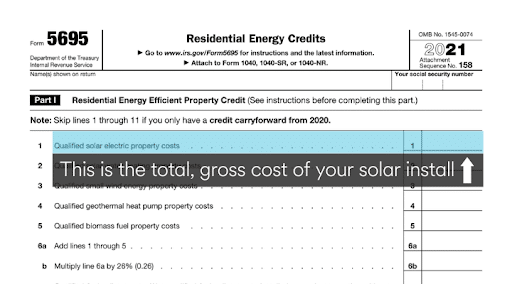

- First, make sure you keep track of any receipts for work done relating to your system installation. The qualified solar costs that you can claim on your return include electrical, roof work, permitting and inspection costs, and energy storage costs, in addition to the panels and inverters of your solar energy system. The gross cost of your project is used to determine what you can claim as the tax credit.

- Second, make sure you know if you will be claiming any other tax credits. Every tax credit you claim reduces your tax liability, so if you’re claiming a child tax credit, adoption tax credit, mortgage interest credit, or other credit that will reduce your tax liability, be sure to know how much you’re claiming for each credit before starting to work on tax form 5695.

You can use this credit limit worksheet to help figure out that number before filling out form 5695. The relevant worksheet section is on page 4.

The relevant parts of form 5695 when claiming credit for installing solar at your home are highlighted here:

For a thorough set of step-by-step instructions and other worksheets, head to the page the IRS maintains for form 5695.

Go Solar Now and Save More!

Purelight Power can help you design a solar energy system for your home’s needs. We make solar even more affordable by wiping out your power bill, so your monthly utility costs go towards owning your solar system rather than renting dirty energy from a power company.

With a quick 30-second survey, you can determine if your roof qualifies today!