Looking for a way to have energy independence while saving thousands of dollars? Let us show you how to take advantage of tax rebates and incentives in Montana to save on solar.

Until the end of 2022, Montana homeowners looking to go solar have three stellar ways to save money on the switch to renewable energy.

Figuring out how each solar rebate and tax incentive in Montana works might feel overwhelming at first, we break it down into easy, understandable steps.

That’s because at Purelight Power our goal is to make the switch to solar easy and affordable for every homeowner. Keep reading, and we’ll guide you through the rebates and incentives available, and explain how each one works.

Solar Tax Incentives in Montana

First, let’s clarify the different ways you can save.

The largest of the three ways to save, the federal solar tax investment credit, is claimed on your income taxes the year you had your solar energy system installed. Other tax incentives may be automatically applied exemptions from things like property taxes, or smaller state-level tax exemptions claimed on your state taxes.

For homeowners who get their power from NorthWest energy or other investor-owned utility companies, and most customers with MECA, you can keep the savings going with net metering.

Just remember that to get the most out of your solar system, it’s a good idea to go with a professional installer to make sure you receive thorough warranties on all equipment and work done. For instance, at Purelight Power, we offer a 10 year workmanship guarantee, 20 year panel warranty, and 25 year production guarantee on every system.

How the Solar Investment Tax Credit Saves Thousands

So long as you have your solar installed before December 31st, 2022 on your primary or secondary residence, you can claim a credit up to 26% worth the cost of your solar system. The solar energy system must be new, and being used for the first time, for you to claim this credit on your federal income taxes.

There are a few other key things to know prior to claiming the Solar ITC:

- The Solar ITC can only be claimed on systems that are owned (this includes financed systems). Leased systems cannot be claimed.

- The credit can’t be claimed on residential properties rented to others except if you also live at the property at least half time. Renting a home you also live in to roommates is fine.

- Don’t worry if your tax liability (how much you owe in taxes based on your income) is less than the credit amount you’d claim. You’re able to carry over the credit to the following year. For 2022, you simply wouldn’t owe any federal tax, and the next year you’d have some credit left over to reduce your tax liability.

For example, say you purchase or finance a solar energy system worth $27,000, you can claim up to $7,020. If your tax liability is $5,200 for 2022, you wouldn’t owe any federal taxes, and in 2023 you’d have another $1,820 from the original credit to put towards lowering your tax liability.

To find out more about how to claim the Solar ITC on your federal income tax return, we have a blog with a more in-depth look.

Save More with Montana’s Solar Tax Incentive

In addition to the solar tax investment credit, Montana offers a tax incentive as well. While it’s not as much as the solar ITC, it’s still a nice bonus to help you save.

For Montana, the tax incentive is $500 for individuals and $1,000 for households who install solar. Again, this credit can be carried over in case you can’t claim the full amount on your next tax return. You have the next four years to carry it forward and save.

Added Value Not Higher Property Taxes

The high, wide, and handsome state of Montana has one last awesome exemption that helps homeowners save.

For a decade after you install solar, you won’t see the added value impact your property taxes. There is a cap for residential systems of $20,000 in value being exempt, but that’s still a great deal considering solar energy systems raise the value of most homes by upwards of 4%

Most homeowners who go solar plan to stay at their homes for the foreseeable future. But it’s still great to know that the investment you made in solar is adding value to your home without causing your property taxes to spike.

Save More with Solar in Montana!

Between the Solar ITC federal and Montana state tax savings, exemption from property taxes for a decade, and Purelight Power designing a system to wipe out your power bill so you can go solar for zero down, you can make your dreams of energy independence real.

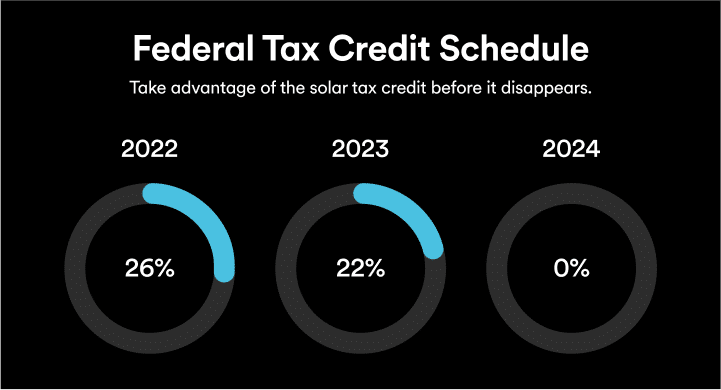

Sounds too good to be true? There is one major catch: the largest of those money savers only lasts til December of this year. The 26% for the Solar Investment Tax Credit drops to 22% for 2023, and then disappears.

Don’t miss out on your chance to go solar affordably! With a quick 30 second survey, you can find out if your roof qualifies today!